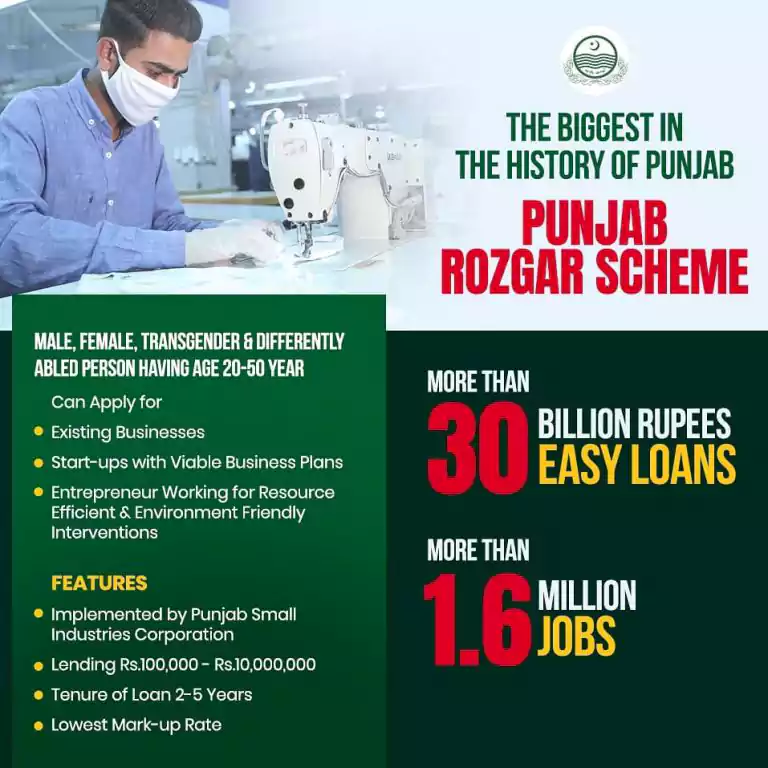

The Punjab government has launched an employment scheme in collaboration with Small Industries Corporation and Bank of Punjab. So far many people have registered in Punjab Employment Scheme and if you also want to register in Punjab Employment Scheme, you can register online now.

Table of Contents

Punjab Rozgar Scheme 2021 Registration | How To Apply

President Rozgar Scheme 2020 Apply Now in Online

The Punjab Employment Scheme was launched by Punjab Chief Minister Usman Bazdar on October 1, 2012. Its primary objective is to provide employment to the young generation and provide them loans on easy terms so that they can make a living. Be able to run your own business.

Ehsaas Emergency Cash Programme budget increased to Rs 203 billion

Who can apply for apply for Scheme?

1 Those who have done their studies from school, college or university can apply for this scheme

2 Or they can apply for TPE Those who have a diploma certificate

3 And are skilled artisans do it in the employment scheme 2020 You can register online.

4 Due to the COVID-19 epidemic, the existing business will now be given priority

5 The business should be run in a clean and transparent manner with macro enterprises and other business resources so that those who are skilled should have the skill to show their shape so they will be provided loans on easy terms.

6 Both men and women, transgender people between the ages of 20 and 5 0 and those who are Disabled can apply and be part of the Sense Employment team.

How Much loans will be provided under the Punjab Rozgar Program?

Under Punjab Employment Scheme, loans of Rs. 30 billion will be provided in which you can get Rs. 100,000 to Rs.10,000,000.

Benefits Punjab Rozgar Program 2021

- This loan Minimum mark-up rate

- Punjab Employment Scheme has been launched and organized in collaboration with Punjab Small Industry

- Huge amount of loan will be provided PKR 100,000 / – to 10,000,000 /

- For Punjab Small Industries Corporation, if you loan, you will get it for two to five years.

Criteria For Punjab Rozgar Scheme 2021

Criteria For Punjab Rozgar Scheme 2021

The following eligibility criteria will be met for processing loans under the Punjab Rozgar Program:

- Age: 20 to 50 years old

- Gender: male / female / transgender

- Resident: Pakistani citizen residing in Punjab, verified through CNIC

- Business Location: All districts in Punjab

- Business type: Whether it is to work as a businessman or to join someone or to do some other business according to one’s skills Must have a clean e-CIB / credit history

- For startups / new businesses

- Having a viable business plan

- For existing business

- A strong and business plan should be formulated keeping in view the current Coronavirus situation

- Having a valid CNIC in And that too Punjab

- Any other parameter set by Punjab Small Industries Corporation (PSIC) / government.

Related searches

- punjab rozgar scheme 2021 online apply

- cm punjab loan scheme 2021 online apply

- punjab rozgar scheme online apply

- punjab rozgar scheme application form

- punjab rozgar scheme last date to apply

- punjab rozgar scheme 2020 application form online apply

How To Apply For Punjab Rozgar Scheme 2021

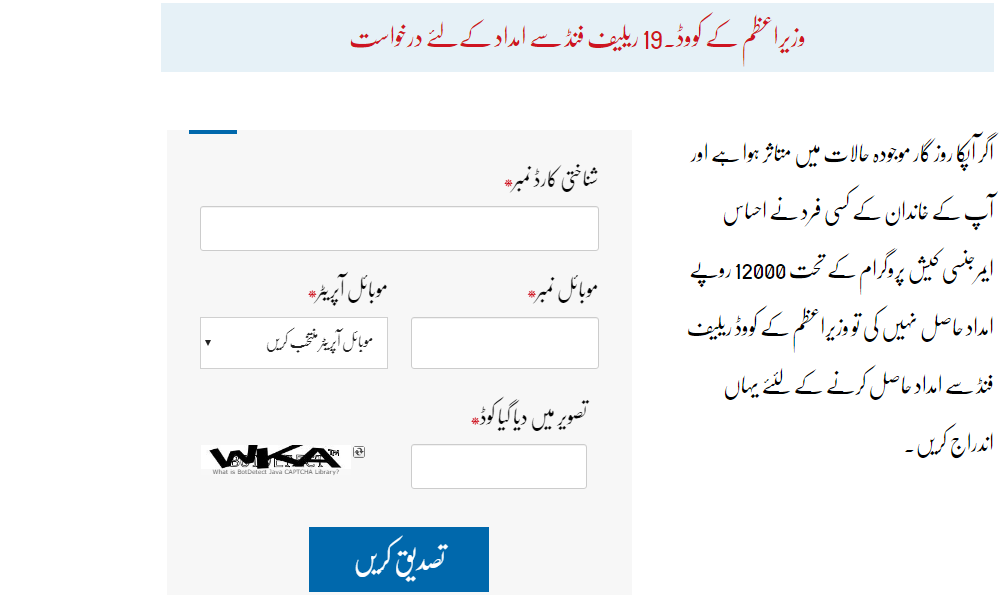

Applicants can go to National WhatsApp and apply online by logging out of Punjab Employment Scheme web portal and online. And if you want to apply online on Punjab Employment Scheme, you can apply online by clicking on the link below.

Terms and conditions

| Feature | Description |

| Loan limit | Up to Rs. 10.00 million Net lendings: from Rs. Rs 100,000 1,000,000 / -Secured lending: from Rs. 1,000,001 / – up to Rs. 10,000,000 / -Under the Punjab Green Development Program. And Ten million has been limited for this scheme The loan limit will remain the same. However, preference will be given to micro-enterprises ready to implement technologies that improve the environment, with a staff of up to 10 to 12 people. |

| Purpose of the loan | Starting a new business balancing, Modernization and Replacement (BM&R) for Existing FacilitiesWorking capital |

| IHR sector | Manufacturing, service, trade, agriculture, and animal husbandry(Green / quality-enhancing micro enterprises as defined above will also be considered under the Punjab Green Development Program) |

| One-time commission | Application processing fee Rs. 2000 / – (not refundable) at the time of application |

| Loan term / Repayment term | From 02 to 05 years old, including the grace period You have to repay the loan that you have taken during this period |

| Grace period | Up to six (06) months (however, a surcharge will apply during the grace period) |

| Loan type | Punjab Rozgar Program Term loan following the policy of the bank and working capital |

| Capital cost | The cost of capital paid by the Borrower:4%\ 5% for net lending5% for secured loans |

| Debt: Equity | 80:20 (for men)90:10 (Women, transgender, and disabled people)(This means that the borrower will invest 20% / 10% ya 21% / 11% of the project cost) |

| Granting loans | By installments (s) according to the approved business plan |

| Loan security | 1. Ensuring net lending Loan limit security from Rs 100,000 500,000 / -Personal guarantee of the borrower together with a statement of net worth. Loan limit security from Rs. 500 001 / – up to Rs. 1,000,000 / . The Borrower’s Personal Guarantee, together with at least one Third Party Guarantor, the total net worth of which is collectively equal to the amount of the loan provided. (The third party must be a Pakistani citizen and resident of Punjab with a valid CNIC and must not be older than 55 years old. The third party’s electronic CIB must be clean, meaning it must not have expired or written history.) OrA BS-10 or higher civil servant guarantee together with a personal guarantee of the borrower. (Departmental guarantee of a civil servant will be mandatory)Net Worth / Wealth Description and Calculation Criteria: Net worth can be in the form of tangible assets, i.e., ownership or possession of a vehicle. It can be estimated as follows: A. Property can be valued at the appropriate DC rate. OrB. Property valuation can be done based on a tax return. OrC. Assessment approved by the Pakistan Banks Association (PBA) by appraiser/agent OrD. The car is valued against the invoice less depreciation (10% for each year).2. Securing the credit limit from Rs. 1,000,001 / – up to 10,000,000 / -Asset mortgage Asset description A. Residential/commercial/industrial/agricultural property/vehicle with a clean title and open access (acceptable to the bank) and assessed by a bank-approved appraiser by the bank’s policy. B. The property must be registered in the borrower’s name or blood relative of the individual/owner/partners. C. Documentation must be consistent with the credit policy of the bank / legal unit. Accrual/mortgage of fixed assets/working capital following internal/external rules. |

Punjab Rozgar Scheme 2021