We will tell you in this article Imran Khan Prime Minister of Pakistan after 2019 Imran Khan made a scheme for the youth to give interest free loans to the unemployed youth

so that they can move forward in their daily life.Prime Minister of Pakistan Imran Khan made this a good scheme that people who are unemployed can start their own business through this scheme to earn money andsupportthemselves.

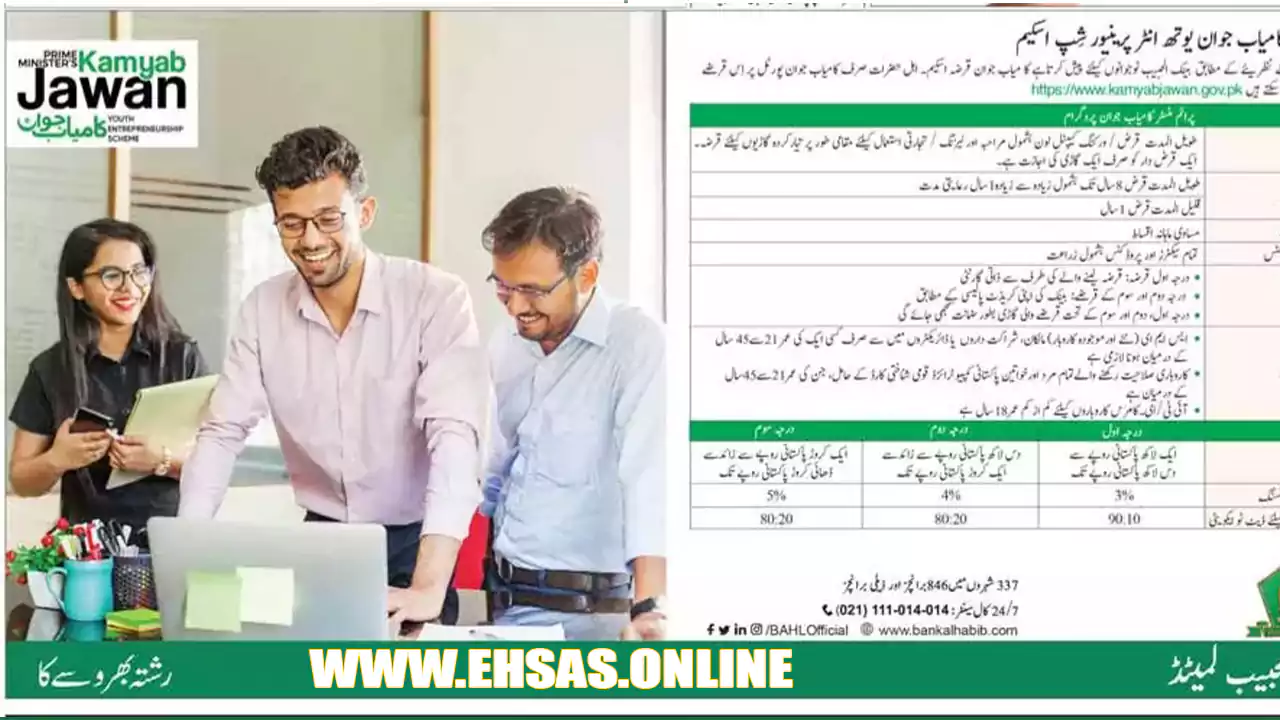

Loans have been announced for small businesses, for construction of houses, and for farmers. Before the successful Pakistan program, the government has also launched a scheme to give loans to young people for business under the successful youth program.

The program is being touted by the government as an effective initiative to eradicate poverty in the country and will be given to families who are included in the Ehsaas program database in Pakistan.

How to apply for nojawan loan :

We will tell you that every young person can apply in the youth scheme, the procedure is very kind and you should apply soon because the loans have started.The applicant shall apply directly via Prime Minister Kamyab Jawan portal i.e https://kamyabjawan.gov.pk/bankform/newapplicantform.

Documents:

- A clear picture

- Images from both sides of National Shakti Card

- Recent educational certificate

- Technical degree relevant to the business for which application is to be submitted

- All experience certificates

- License if required like commercial vehicle or medical store

- Evidence of skill/craftsmanship

- NTN and latest tax returns, we suggest to get NTN before submitting application

- Electricity Connection Reference/Consumer Number at residential address

- Business Estimate/Actual Estimate/Expected Business Income and Expenditure

- Brief introduction of your business

- Any other source of income, such as income from abroad, salary income, agricultural income etc

- Registered vehicle number in your name and in case of female, registered vehicle number can also be given in the name of parents.

- ID card copies of 2 referring persons

- Documents proving the existence of the entity in case of partnership/ limited company

Who is eligible for PM loan scheme?

For IT/E-Commerce related businesses, the lower age limit will be 18 years and at least matriculation or equivalent education will be required. Above age limit condition is applicable on individuals and sole proprietors.

The announcement of more than 400 billion interest-free loans under the successful Pakistan program comes at a time when the government has also reduced the prices of petrol, diesel and electricity in the country.

What is government interest free loan 2022?

Government provides an interest free loan for students subject to a maximum loan amount of Rs. 800,000 for pursuing degree programs with higher market demand and professional value, which are approved by the Ministry of Education.

How do I get a loan from the ehsaas program?

Interest Free Loan in Pakistan 2024-24 Eligibility Criteria

- 1_ Age between 18 to 60 years.

- 2_ Individuals from households on Score of 0-40 on Poverty Score Card.

- 3_ Valid National Identity Card (CNIC)

- 4_ Resident of targeted union council of the district.

- 5_Economically viable business plan.

- How can I get a 50k instant loan?

- 1_ Eligibility Criteria for Rs. 50,000 Instant Loan

- 2_You must be between the ages of 21 and 57 to apply.

- 3_You must have a monthly income of Rs. 13,500 or more.

- 4_Income must be credited directly to your bank account.

- 5_ You must have a minimum CIBIL score of 600 or minimum Experian score of 650.

How do I check if I qualify for a loan?

- Here are five common requirements that financial institutions look at when evaluating loan applications.

- Credit Score and History. An applicant’s credit score is one of the most important factors a lender considers when evaluating a loan application. …

- Income. …

- Debt-to-income Ratio. …

- Collateral. …

- Origination Fee.

Can I get a personal loan for 5000?

You can get a $5,000 personal loan from online lenders, banks or credit unions. However, lenders may have different loan amounts available. You will need to meet the lender’s requirements, which typically include a minimum credit score and income.

What’s the monthly payment on a 50000 loan?

The monthly payment on a $50,000 loan ranges from $683 to $5,023, depending on the APR and how long the loan lasts. For example, if you take out a $50,000 loan for one year with an APR of 36%, your monthly payment will be $5,023.31

What is a good loan score?

Lenders generally see those with credit scores 670 and up as acceptable or lower-risk borrowers. Those with credit scores from 580 to 669 are generally seen as “subprime borrowers,” meaning they may find it more difficult to qualify for better loan terms.

Will the government give a loan for one year?

Under the expanded program, interest-free loans worth Rs 407 billion will be provided across the country by the end of this fiscal year and the next two fiscal years.

The government has planned to provide these loans not only for the next three years but also in the next years. According to government documents, interest-free loans of Rs.1000 billion will be provided by the end of the financial year 2025-26.

How to get interest free loans under the program?

A portal has been developed by the government to get loans under the Succeed Pakistan program and through this toll free phone number any person who wants to take a loan can know whether he can get this loan or not.Once the loan eligibility is confirmed, the program forms in Urdu and English languages will be available on the government portal.

How much financial burden will the government bear?

Loans under the Succeed Pakistan Program will be released from the country’s banks to the common people, but the government will pay the interest rate charged by the banks as a subsidy from its own pocket.

It should be noted that the International Monetary Fund (IMF) has objected to the concessional loans given by the government in the construction sector, but now the government will issue loans from banks under this program and pay the subsidy from its own pocket. Will do.